Perspectives

Super spender growth is 100% – more members taking more expensive drugs, Part 2

Many are scientific breakthroughs for diseases that have never had a treatment

February 24, 2021The top 0.032% sliver of members – the drug super spenders – may be hanging big hopes on the new innovations being brought to market by pharmaceutical companies. For some, these drugs could mean the difference between life and death. For others, a greatly improved quality of life. And these costly treatments will certainly lead to an increase in drug expenses.

As drug therapy costs rise, patients’ out-of-pocket costs also go up. Complex conditions create pressure on the entire family. That can impact a range of social determinants of health, like economic stability, support systems and transportation.¹

As more of these therapies come to market, our focus needs to be on helping. improve affordability and remove barriers to a positive patient experience, while also helping both members and clients manage the tremendous cost challenges these new therapies bring.

A large family of orphan drugs is emerging

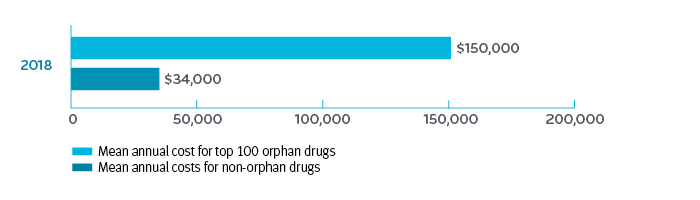

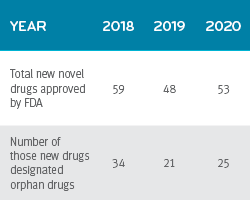

Orphan drugs have made up one third to one half of new drugs approved by the FDA in the last three years.² ³ 4 The cost of orphan drugs is almost 4.5 times higher than other drugs on the market ($150,000 per patient per year (PPPY) compared to $34,000 PPPY).5

U.S. mean annual cost of top 100 orphan drugs compared to non-orphan drugs, 2018 5

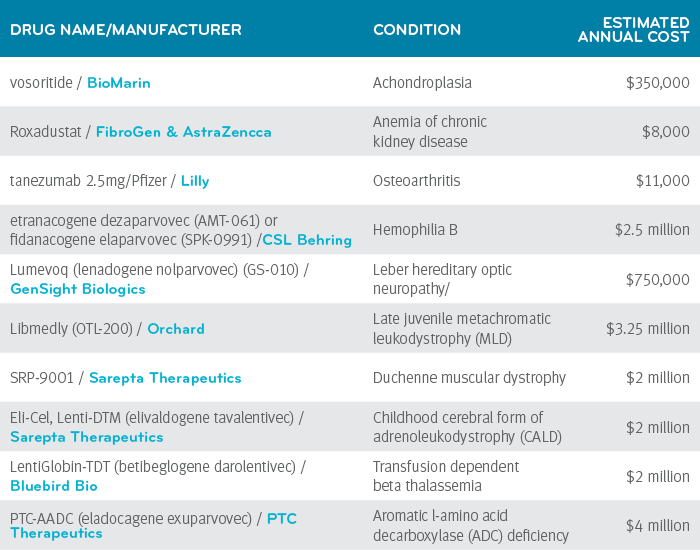

More than a dozen gene and cell therapies are on the market start at $250,000/year. The prices go up from there. Zolgensma® is currently the most expensive drug in the world at $2.125 million.

Going forward, innovative new treatments will be approved by the FDA at a faster and faster rate. The FDA expects to be approving 20 to 25 new gene and cell therapies a year by 2025.

More than 800 gene and cell therapies are in the drug pipeline right now.7 They probably won’t all go through testing Phases 1, 2 and 3 as fast as the COVID-19 vaccines did, and those gene and cell therapies may not all be as successful as the COVID-19 vaccines. But when exciting new breakthroughs do receive FDA approval, we are right there to help make sure our clients are ready to distribute the drugs appropriately and support their members.

More than 800 gene and cell therapies are in the drug pipeline right now.7 They probably won’t all go through testing Phases 1, 2 and 3 as fast as the COVID-19 vaccines did, and those gene and cell therapies may not all be as successful as the COVID-19 vaccines. But when exciting new breakthroughs do receive FDA approval, we are right there to help make sure our clients are ready to distribute the drugs appropriately and support their members.

Prime’s experts proactively monitor the drug pipeline and follow critical market trends

At Prime, we study the drug pipeline for important impacts to health care cost, quality of care, regulatory and policy issues and major new clinical findings. Our state-of-the-art forecasting methods use integrated medical diagnoses and pharmacy claims.

This gives us a deep understanding of the high-cost drugs coming onto the market. Often, for Value-based contracting/agreement, we work with manufacturers before a drug’s approval. Many contract framework decisions can be made ahead of time, such as zeroing in on a specific outcome goal like adherence, reduced ER visits, or hospitalizations.

Prime helps keep clients informed about the pipeline through monthly webinars and a suite of publications called Prime Drug Insights. High-cost drugs in the pipeline are given additional analysis and may be placed on a Drug Watch list. Drugs included on the Drug Watch list have been submitted to the FDA for review and/or are expected to have a high material impact to either:

- Trend (>$0.08 PMPM) or

- Preferred product strategies (medical or pharmacy)

The table below lists a few of the drugs we are watching that have expected FDA decision dates in 2021.

When a high-cost drug is approved, it’s ‘go time,’ not ‘let’s get ready’ time

Management strategies need to be developed and coordinated for when the drug is approved and available. FDA-labeling may not be finalized until very close to the approval date. Nuances of labeling can make a big difference to how drug management tools may be applied. How each market will be affected will be different: commercial, Medicare and Medicaid.

Strategies vary depending on whether the drug falls under pharmacy or medical benefit. We help our clients understand and apply FDA indication labeling for their membership, providing guidelines for UM (pharmacy benefit) or drug policy (medical benefit).

A lot of gene and one-time therapy treatments will occur at designated, specialized centers. Most patients will travel for treatment. Management of multiple locations can mean wide variability in cost and reimbursement rates. Contract details will need to accommodate multi-state structure and process. In many cases, we will need to rely on our national network of Blue Plan owner clients to provide consistent claims reporting for contract support. That will help support cost management.

The complexity of these strategies make it critical to prepare clinical and pricing recommendations as much as possible before the launch of a high-cost drug.

From pipeline to pact: the path to value-based contracts

In an article in FiercePharma, Michael Choy, partner and managing director at Boston Consulting Group, said : “[Value-based contracts] … will continue to dog the industry. There’s a lot of interest in outcomes-based payments and payments over time. The issue is they’re very difficult to implement because the infrastructure to track outcomes over time doesn’t really exist.”7

Well, maybe for the other guy.

Prime has been in value-based contracts for more than ten years, including several with manufacturers of ultra-high cost therapies. They help make our Blue Plan clients more competitive in their markets. They align payers, employers and doctors to work toward achieving desired health outcomes.

Our experience with value-based contracts puts us a step ahead of other PBMs. We have experience in complex contracts.8 The focus ranges from adherence and persistency to clinical outcomes, cost of care and price caps.

We’ve also have contracts that require following a member for more than a year. We’re fine with that. A lot of members who change plans just move from one Blue Plan to another Blue Plan. We have experience in tracking members.

Often, Prime starts negotiations with price to value

Many of these big ticket drugs have large price-to-value gaps.9 Typical measures don’t apply. We work with value frameworks from the Institute for Clinical and Economic Review (ICER) and we have our own value frameworks.

Prime works very hard to negotiate contracts to help keep drugs priced to value. Prime’s value-based contracts bring key industry players together to work to help improve health outcomes and lower the cost of care. We can work together to improve pricing and accountability.

Drug super spenders and the high cost drugs they take are shaping the future of health care. Prime’s business model gives us unique advantages in two key skills needed meet the challenge: pipeline management and value-based contracting.

Progress has always depended on those who can form connections — and go beyond spreadsheets to see a more holistic view of health care solutions. It’s why our collaboration with our Blue Plan client owners is at our core. And we believe it’s the only way to make health care work better for all of us.

References

- Racial and Ethnic Inequality: A Public Health Perspective, July 16, 2020. © 2021 Rare Genomics Institute. Accessed at: https://www.raregenomics.org/blog/racial-and-ethical-inequalities

- Advancing Health Through Innovation: 2018 New Drug Therapy Approvals. U.S. Food & Drug Administration. https://www.fda.gov/media/120357/download. Accessed Sept. 20, 2019.

- Advancing Health Through Innovation: 2019 New Drug Therapy Approvals. U.S. Food & Drug Administration. Accessed at: https://www.fda.gov/media/134493/download

- Novel Drug Approvals for 2020. U.S. Food and Drug Administration. Jan. 13, 2021. https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2020

- EvaluatePharma® Orphan Drug Report 2019. 8th Edition. April 2019. Copyright © 2019 Evaluate Ltd. All rights reserved. Accessed at: https://www.evaluate.com/sites/default/files/media/download-files/EvaluatePharma_Orphan_Drug_Report_2019.pdf

- Estimating the Clinical Pipeline of Cell and Gene Therapies and Their Potential Economic Impact on the US Healthcare System. Value in Health Volume 22, Issue 6, June 2019, Pages 621-626.

- Pharma’s gene and cell therapy ambitions will kick into high gear in 2020—despite some major hurdles. by Arlene Weintraub. Dec 19, 2019. Fierce Pharma. © 2021 Questex LLC. All rights reserved. Accessed at: https://www.fiercepharma.com/pharma/gene-and-cell-therapy-r-d-will-kick-into-high-gear-2020-despite-hurdles-experts-say

- Not tomorrow. Today. Putting more value in value-based contracts, by Pat Gleason. October 30, 2020. Prime Insights. PrimeTherapeutics.com © 2021 Prime Therapeutics LLC. Accessed at: https://www.primetherapeutics.com/en/news/prime-insights/2020-insights/insights-2020–Not-tomorrow-today-Putting-more-value-in-VBCs.html

- Mind the gap: Using a drug’s price-to-value calculation, by Pat Gleason. December 19, 2019. Prime Insights. PrimeTherapeutics.com © 2021 Prime Therapeutics LLC. Accessed at: https://www.primetherapeutics.com/en/news/prime-insights/2019-insights/Story_Mind_the_gap_price_to_value_.html

Related news

Perspectives

July 25, 2024

Quarterly Drug Pipeline: July 2024

Clinical insights and competitive intelligence on anticipated drugs in development

Perspectives

July 22, 2024

Oncology Insights: 2024 ASCO Annual Meeting key findings

Findings from this year’s American Society of Clinical Oncology (ASCO) Annual Meeting will likely lead to clinical practice changes and U.S. Food and Drug Administration (FDA) drug approvals or expansions

Perspectives

July 16, 2024

LISTEN NOW: Beyond the business – Stories of corporate kindness | Pharmacy Friends Podcast

In this episode, we talk about how our employees' help goes beyond our work in health care, aiding in philanthropic efforts