Perspectives

Wait and see … is not a cost of care strategy, Part 1

Learn more about drug super spenders –and who may become one

February 16, 2021This three-part series looks at drug super spenders: Part 1 looks at who these members are. And why integrated data is so crucial to understanding their health care needs and health care costs. Part 2 examines why this group of members is growing so fast. It looks at Prime’s effective use of pipeline management and value-based contracting. Part 3 looks at solutions that can support health outcomes and save millions of dollars on high-cost drugs.

Drug super spenders – members with total drug costs over $250,000 a year – need special care. To optimize health outcomes and help control costs for drug super spenders, health plans will need:

- Drug management strategies that integrate medical and pharmacy benefit data

- Pipeline management for high-cost drugs, cell and gene therapy

- Innovative manufacturer contracting – like value-based contracting

- A dedicated team to optimize drug therapy combined with robust case management

- Integrated Fraud, waste and abuse (FWA) capabilities

- This is the first of a three-part series. Much of the data are drawn from Prime’s research on drug super spenders presented at the Academy of Managed Care Pharmacy in October 2019 and October 2020.¹ ²

Who is a drug super spender?

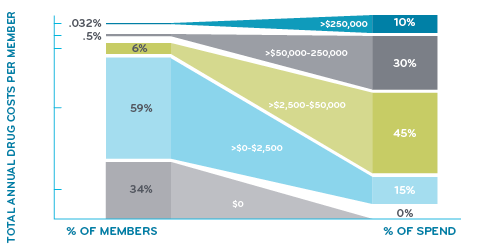

Just a tiny 0.032% of members, that’s only 32 per 100,000 with more than $250,000 in drug costs during a year. But it adds up fast. It adds up to nearly 10% of the total drug spend. These are the drug super spenders.

What about the rest of us?

Just over 90% of members have less than $2,500 in drug costs during a year. A third of members have no prescriptions at all. So, when most people talk about drug costs, they’re probably talking about monthly premiums or their deductibles.

What are the drugs in the under $2,500 crowd? They are all common generic drugs: several forms of opioid and non-opioid pain relievers, birth control, high cholesterol and high blood pressure drugs, stomach acid reducers, antibiotics, metformin (for diabetes), antidepressants, and many more.

About 6% of members have drug costs between $2,500 and $50,000. Who’s in that group? A lot of members with diabetes have drug costs in that range, so do some members taking drugs for heart disease. Members taking medication for severe migraines or severe asthma may fall in this category.

In this study of commercially insured members, people move up and down from one category to another. Very few move up into the drug super spender category, just 0.032%.

In 2019, just 5,900 drug super spenders (out of 18 million commercially insured members) racked up over $2.6 billion in total drug costs.

The growth trajectory of drug super spenders is steep

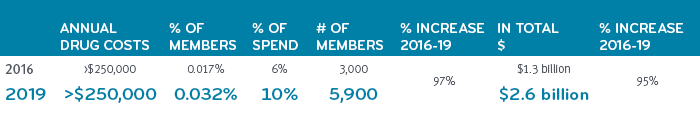

The number of these drug super spenders with total annual drug costs over $250,000 has grown nearly 100% between 2016 and 2019. We expect that growth rate to continue and become 15% of total drug expenditures within a few years.

Growth in drug super spenders, 2016-2019, Prime’s commercial book of business

Comprising less than one half percent of all members, drug super spenders represent just 32 people per 100,000 members, on average. So, an employer group of 15,000 or 20,000 people might have one or two members in this super spender group. One employer might have none, while still other employers might have ten. Sometimes it simply comes down to the luck of the draw. However, odds are that an employer will have a drug super spender covered by their benefits at some point. It’s not something to ignore. With the proliferation of costly treatments and the escalating prevalence of high cost chronic diseases, it’s not a matter of if, but when. Companies can’t afford to just to wait and see. It could take them under.

What conditions have drugs that are this expensive?

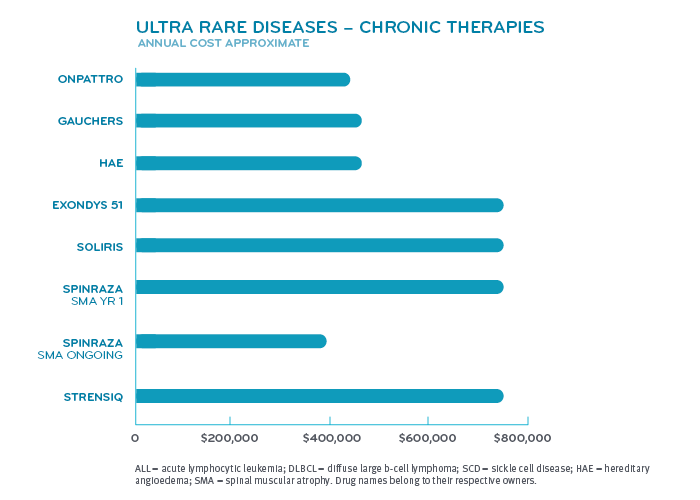

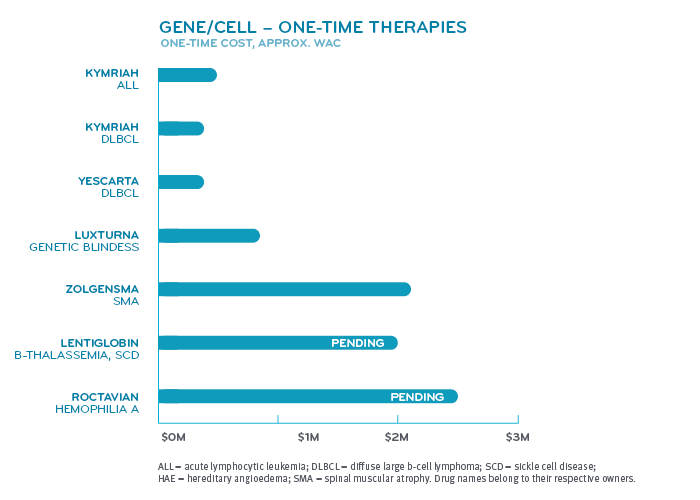

Super spenders have serious health conditions. Various forms of cancer make up nearly half of the conditions for those among drug super spenders. Inherited single gene disorders make up the next largest group. Within that group fall conditions like hemophilia A and B, cystic fibrosis, spinal muscular atrophy and hereditary angioedema. Other categories include pulmonary hypertension, multiple sclerosis and disorders treated by the drug Soliris® (eculizumab) like paroxysmal nocturnal hemoglobinuria and myasthenia gravis.

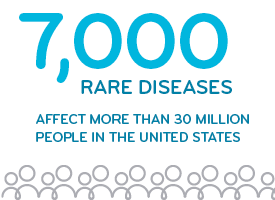

Many of these diseases or disorders affect fewer than 200,000 patients in the United States, giving the drugs that treat them orphan drug status. The FDA reports that more than 7,000 rare diseases collectively affect more than 30 million people in the United States. Hundreds of them have treatments, but most do not.3 Development of these drugs are given tax incentives under the Orphan Drug Act. Orphan drug manufacturers can tax credits for R&D costs, R&D grants and may get clinical trial tax incentives. These are to offset developing a drug for a smaller market.³

Many of these diseases or disorders affect fewer than 200,000 patients in the United States, giving the drugs that treat them orphan drug status. The FDA reports that more than 7,000 rare diseases collectively affect more than 30 million people in the United States. Hundreds of them have treatments, but most do not.3 Development of these drugs are given tax incentives under the Orphan Drug Act. Orphan drug manufacturers can tax credits for R&D costs, R&D grants and may get clinical trial tax incentives. These are to offset developing a drug for a smaller market.³

A lot of treatments for these complex conditions are multimodal. That means several different forms of treatment are used at the same time. That may include using several specialists. Members with these conditions have a complex health care support system. They see multiple specialists and doctors. They may go to several clinics. Ongoing treatment may involve hospital stays, travel and time off work for themselves or family.

A lot of treatments for these complex conditions are multimodal. That means several different forms of treatment are used at the same time. That may include using several specialists. Members with these conditions have a complex health care support system. They see multiple specialists and doctors. They may go to several clinics. Ongoing treatment may involve hospital stays, travel and time off work for themselves or family.

Our health outcomes research can provide real world information about how these rare new treatments are being used. Our Blue Plan clients can use this information to help the providers and hospitals in their systems improve the care they provide.

Our health outcomes research can provide real world information about how these rare new treatments are being used. Our Blue Plan clients can use this information to help the providers and hospitals in their systems improve the care they provide.

Analyzing drug super spenders takes integrated data

Looking at integrated pharmacy and medical drug data is especially critical to understand total drug costs of drug super spenders. Omitting medical drug data would change the drug super spender list and hobble a health plan’s ability to execute cost-saving strategies. (Read about these strategies in Part 3). Here are just a few of the reasons integrated data is so important:

- Nearly one third of drug costs are processed under the medical benefit. Medical drugs are usually administered in a health care setting by a health care professional. Analysis of pharmacy costs only is missing all of these costs – and does not provide an accurate picture of total drug expenditures.

- Benefit design can vary – the same drug may be billed under the medical benefit on one plan and under the pharmacy benefit on another plan. Again, looking only at pharmacy data, key data could be missing. And when a drug gets moved from one benefit to the other, the result could be false “savings.”

- Many conditions require treatment with both medical drugs and pharmacy drugs. Looking at the drug costs of one condition without medical drug data? That’s not total. That’s incomplete.

- For many specialty conditions, 70 to 80 percent of the total cost of care, or even more, may come from drugs. If most of that care comes from medical drugs, looking at pharmacy claims alone will show a very skewed cost of care. Those members might fall off the drug super spender list altogether.

Nothing less than total drug cost management will do

At Prime, we’ve been working with integrated medical and pharmacy claims for 20 years. We understand how these benefits interact. Using integrated medical and pharmacy claims gives us a complete view of our membership, how these high-cost drugs are being prescribed, and used.

Some strategies in the PBM industry just push costs back and forth from the medical benefit to the pharmacy benefit. But lowering costs in one area doesn’t help if costs go up in another area. It may appear to be saving money, but the cost has just been moved somewhere else.

Because of Prime’s unique business model of Blue Plan ownership, we like to say that we have health plan DNA. Our data scientists have access to medical data streams from our health plan clients; and they are experienced in analyzing integrated pharmacy and medical data.

Unless you’re looking at integrated costs, you’re not looking at total costs. And how can you manage costs if you don’t really know what the costs are?

Unless you’re looking at integrated costs, you’re not looking at total costs. And how can you manage costs if you don’t really know what the costs are?

Prime’s integrated research works to prove and improve Prime’s benefit design and clinical offerings with an eye on improving health outcomes and cost efficiency.

Prime’s integrated research pushes to look past a fragmented system toward innovative solutions that can help set the member up for success.

Prime’s integrated research provides book-of-business analysis and actionable, plan-level detail for recommendations that help make a difference at the local level.

References

- Bowen K, Starner C, Gleason P. 2016 to 2019 Trend in Integrated Total Pharmacy Plus Medical Benefit Drug Spend—Doubling of Members with Extremely High Annual Drug Cost within a 17 Million Commercially Insured Population. Academy of Managed Care Pharmacy virtual national conference. October 2020. Accessed at: https://www.primetherapeutics.com/content/dam/corporate/Documents/Newsroom/Pressreleases/2019/document-amcpposter-superspenders.pdf

- Bowen K, Gleason P. Drug Super Spenders: 2016-2018 Growth in Number of Members and Total Pharmacy Plus Medical Benefit Drug Cost for Members with Extremely High Annual Drug Cost in a 17 Million Member Commercially Insured Population. Academy of Managed Care Pharmacy national meeting Baltimore, MD. October 2019. J Manag Care Spec Pharm 2019:25(10-a):S90. https://www.jmcp.org/doi/pdf/10.18553/jmcp.2019.25.10-a.s1

- Orphan Drug Act – Relevant Excerpts. U.S. FDA. Updated: 9/9/2018. Accessed at: https://www.fda.gov/industry/designating-orphan-product-drugs-and-biological-products/orphan-drug-act-relevant-excerpts

Related news

Perspectives

April 15, 2024

Oncology Insights: Cancer treatment is personal

Precision medicine, or personalized medicine, uses genes or proteins to diagnose or treat disease. This medical care design has significantly impacted oncology and grew out of a need to improve and individualize patient treatments

Perspectives

April 15, 2024

High-Cost Therapy Profile

Detailed information about prademagene zamikeracel Topical surgical application

Perspectives

April 15, 2024

May 2024 decisions expected from the FDA

Your monthly synopsis of new drugs expected to hit the market