Perspectives

Where’s the value in value-based contracts?

It’s not just pushing data and dollars back and forth.

October 13, 2020Prime’s value-based contracts bring key industry players together to work to improve health outcomes and lower the cost of care.

Can’t we just buy prescription drugs at an affordable price? If Congress passes legislation to lower drug prices, can’t we just forget about all this complicated tracking and reporting?

Probably not.

There is no “easy button” for solving the complexities of drug pricing. But we can work together to improve today’s pricing and accountability.

Value-based contracts are an important way that drug companies back up the claims they make about their products by holding a drug accountable to an outcome measure.

Drug manufacturers like working with Prime

When drug manufacturers work with us, they can reach all 18 of Prime’s Blue Plan owner clients at once. Prime centralizes this capability for our Blue Plans.

When drug manufacturers work with us, they can reach all 18 of Prime’s Blue Plan owner clients at once. Prime centralizes this capability for our Blue Plans.

Our relationship with Blue Plans means we’re able to manage integrated medical and pharmacy data. That’s a useful and unique capability among PBMs. We’ve been working with integrated data for more than 20 years. The resulting ability to craft precise, auditable, results-driven VBCs also makes us a good partner for drug companies.

VBCs provide useful information to help close price-to-value gaps. Much of the payer world talks about moving toward value or performance-based contracts. Drug companies, pharmacy benefit managers (PBMs) and payers support this but are still testing ways to make these concepts work. The VBCs created by Prime and drug companies are moving into these evolving areas. With our VBCs, drug companies build valuable experience in how to design contracts that are:

- Meaningful from an experience perspective

- Simple enough to execute (or just not overly complex)

- Measure an outcome of clinical value to both parties

- Provide enough financial value to make sure it is time well spent

- Provide learnings and a platform for future innovations

Our contract with EMD Serono is a good example.

Prime has a VBC with EMD Serono for the drug Mavenclad.® Mavenclad is the first and only FDA-approved treatment for relapsing, remitting MS and active secondary, progressive MS. Mavenclad provides two years of proven efficacy with a maximum of 20 days of oral treatment, over 96 weeks. In our VBC, EMD Serono provides payment when patients discontinue taking Mavenclad or change to a different drug.

We’ve done a lot of research on multiple sclerosis cost of care. Our findings show that most MS costs are from pharmacy spend. Our 2018 real-world study showed patient adherence to MS disease-modifying drugs was associated with a significant decrease in relapses.2

This contract will track patients for four years. Often, in health care, following a patient that length of time might be unusual. But it’s fine with us, because Blue Cross members tend to stay Blue, even if they move from one job to another. And we are set up to follow Blue Plan members with all their data intact. That helps us manage and control costs for specialty medication users with more continuity.

Prime works to make VBCs that are good for our health plan clients

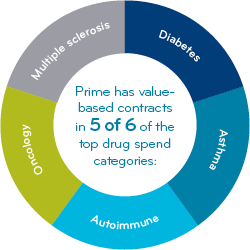

We create tremendous value for clients by focusing VBCs in the top-spend drug categories.

We create tremendous value for clients by focusing VBCs in the top-spend drug categories.

- Multiple sclerosis

- Diabetes

- Oncology

- Autoimmune

- Asthma

We have VBCs in five of the six top drug-spend categories.¹

How is Prime different than other PBMs?

Our pioneering business model means we have Blue Plan DNA. We can read medical claims data as well as we can read pharmacy claims data. To quote Lady Gaga: “Baby, we were born this way!”3

Prime brings the medical and pharmacy threads together into a total cost of care story that our Blue Plan clients have come to depend on. Our health outcomes research shows correlations between medical and pharmacy drug utilization and hospitalizations, emergency room visits and drug condition-specific outcome measures.

We harness that expertise in crafting value-based contracts. These VBCs help make our Blue Plan clients more competitive in their markets. They align payers, employers and doctors to work toward achieving desired health outcomes.

Prime’s works to make VBCs that are good for our members.

Yes, the value of value-based contracts resides in the contract terms — but also in the associated learnings and results. Every successful VBC gives us insights that helps us refine the next one. And many VBCs give us information that’s used to enhance clinical programs and improve health outcomes.

Prime conducts its data analysis in house, so member privacy is protected. Raw data is not transferred to manufacturers or third parties. Typically, results are provided in aggregate; no individual member data is shared. (Other PBMs may use third-party companies for data analysis.)

Prime conducts its data analysis in house, so member privacy is protected. Raw data is not transferred to manufacturers or third parties. Typically, results are provided in aggregate; no individual member data is shared. (Other PBMs may use third-party companies for data analysis.)

As plans save money from the value gained through these arrangements, they either pass the savings on to patients or use it to provide more services. That’s not just a good idea, it’s required by law.4

A study from Avalere Health showed that 58 percent of payers operating outcomes-based contracts reported improvements in patient outcomes.5

Prime’s value-add to today’s high-cost drugs

Value-based contracts make an important contribution to today’s high-cost drugs. High cost specialty drugs now make up 50 percent of the drug spend and that’s still rising. New specialty drugs for orphan conditions often start at several hundred thousand dollars a year. Plus, for many specialty conditions, 70 to 80 percent of the total cost of care, or even more, can come from drugs.6

We write VBCs for ultra high-cost drugs differently. These go beyond measuring adherence. These VBCs rely more heavily on measuring health outcomes and total cost of care. Often, we’ve done price-to-value modeling, and studied value framework models from the Institute for Clinical and Economic Review (ICER).7,8 Knowing a drug’s value framework can identify a price to value gap – the difference between its value-based price and the actual drug price. That’s often where VBCs for high cost drugs start – in that price to value gap.

Prime currently has value-based contracts with drug companies for several ultra-high cost therapies.

Traditionally, pharmaceutical rebate contracts negotiated by PBMs were based solely on the volume of drugs purchased. As growing numbers of high-cost specialty products enter the market, drug companies are asked to substantiate the value their medications can provide when taken appropriately, such as keeping patients out of the hospital and slowing disease progression. This evolved into VBCs, which have become more sophisticated every year.

As an integrated PBM, Prime is uniquely positioned to work with drug companies to develop the next generation of VBCs, aiming to improve health outcomes and lower cost of care.

This is consistent with our evidence-based approach to clinical management. In other words, making health care work better by helping people get the medicine they need to feel better and live well.

References

- Prime book of business

- Multiple sclerosis (MS): a look at cost of care, disease-modifying drugs (DMDs) adherence and relapse rates. July 2018. Prime Insights. Available at: https://www.primetherapeutics.com/en/news/prime-insights/clinical-compendium/CoC_MS_AD_Relapses.html

- Lady Gaga, Born this way. Universal Music Publishing Group. 2011

- Healthinsurance.org. “Glossary: What is the medical loss ratio?” Available at: https://www.healthinsurance.org/glossary/medical-loss-ratio/

- Avalere. “More Than Half of Health Plans Use Outcomes-Based Contracts.” 1 October 2019. Available at: https://avalere.com/press-releases/more-than-half-ofhealth-plans-use-outcomes-based-contracts

- Prime internal analysis

- Getting drug manufacturers to put more than product on the line, by Pat Gleason. November 25, 2019. Prime Insights. Available at: https://www.primetherapeutics.com/en/news/prime-insights/2019-insights/Story_Value_Based_Contracts_more_than_product_on_the_line.html

- ICER Value Assessment Framework. Institute for Clinical and Economic Review. Available at: https://icer-review.org/methodology/icers-methods/icer-value-assessment-framework-2/

Related news

Perspectives

July 25, 2024

Quarterly Drug Pipeline: July 2024

Clinical insights and competitive intelligence on anticipated drugs in development

Perspectives

July 22, 2024

Oncology Insights: 2024 ASCO Annual Meeting key findings

Findings from this year’s American Society of Clinical Oncology (ASCO) Annual Meeting will likely lead to clinical practice changes and U.S. Food and Drug Administration (FDA) drug approvals or expansions

Perspectives

July 16, 2024

LISTEN NOW: Beyond the business – Stories of corporate kindness | Pharmacy Friends Podcast

In this episode, we talk about how our employees' help goes beyond our work in health care, aiding in philanthropic efforts