Perspectives

Biosimilars could make a big difference for neutropenia

Biosimilar options can save millions and still provide quality care

March 26, 2019We take medicine to treat the cancer. And we take medicine to treat the side effects and the conditions caused by the cancer treatment. This makes cancer treatment really challenging.

Most patients with cancer end up needing treatment for neutropenia

Treating cancer with chemotherapy can affect a patient’s ability to make new white blood cells. This is called neutropenia. More than 11,000 patients with cancer develop neutropenia every year. The drugs that treat it bill under the medical benefit.

Prime’s strategy for managing medical drug spend has evolved over two decades of working with our clients’ medical benefit data. It keeps the patient at the center of the decision-making process. It includes:

- Formulary management

- Network management

- Utilization management

- Clinical management

The growth of biosimilars give us a lot of potential for savings in this drug class. We use formulary, utilization and network management strategies to capture savings.

Strategies for medical drug management

Formulary management

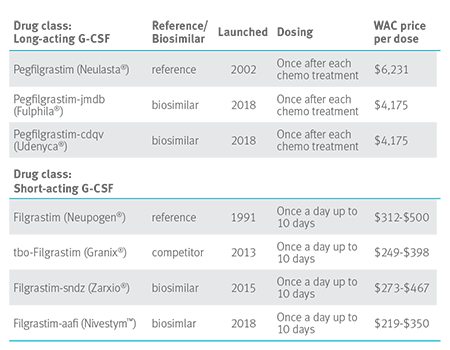

Until recently, there were only two drugs to treat neutroenia: pegfilgrastim (Neulasta®) and filgrastim (Neupogen®) Both are granulocyte-colony stimulating factor (G-CSF), which stimulate the growth of white blood cells. The first is long-acting, the second short-acting.

- New-to-market biosimilar options can save millions of dollars and still provide quality of care for patients.

- A preferred drug strategy can leverage competition between drug manufacturers.

Utilization management (UM)

UM looks different under the medical benefit, but still focuses on getting the right drug to the right patient.

- Medical policy provides guidance for monitoring the safe and appropriate use of medicines on an ongoing basis.

- Medical claim edits use a suite of clinical, financial and utilization logic rules to evaluate drug claim appropriateness.

Network management

Reimbursement solutions identify savings in the physician office, using data on competitive drug reimbursement rates. Instead of each doctor setting their own price for drugs, Prime sets a single reimbursement rate. This gives all doctors the same margin, regardless of the drug cost. The formula can also be set up to incent the selection of preferred drugs.

Drug therapy for neutropenia is short term. New patients get this diagnosis every day. Doctors are making these drug therapy choices over and over, for every new patient. Incenting providers to choose biosimilars can be very effective.

G-CSF drugs that treat neutropenia

Additions in 2018 and 2019 should create further downward price pressure in this drug class.

As the table above shows, Neulasta wholesale acquisition cost (WAC) is $6,231 compared to Fulphia: $4,175 WAC. If 75 percent of the estimated 1,900 Blue Plan members taking Neulasta switched to Fulphila, the book of business savings would be $50 million.

We finally have a handful of biosimilars in the same drug class. We can help you move members to these less expensive biosimilars.

The FDA has determined there are no clinically meaningful differences between the reference product and their biosimilars. They are a safe and effective substitution. We can reduce the cost of care without affecting health outcomes.

Health care is tough. We have a lot of tough decisions to make. Whether to use biosimilars? That shouldn’t be one of them.

Drug names are the property of their respective owners.

Related news

Perspectives

July 25, 2024

Quarterly Drug Pipeline: July 2024

Clinical insights and competitive intelligence on anticipated drugs in development

Perspectives

July 22, 2024

Oncology Insights: 2024 ASCO Annual Meeting key findings

Findings from this year’s American Society of Clinical Oncology (ASCO) Annual Meeting will likely lead to clinical practice changes and U.S. Food and Drug Administration (FDA) drug approvals or expansions

Perspectives

July 16, 2024

LISTEN NOW: Beyond the business – Stories of corporate kindness | Pharmacy Friends Podcast

In this episode, we talk about how our employees' help goes beyond our work in health care, aiding in philanthropic efforts