Perspectives

Biosimilars are at the door

When biosimilars knock on your door, what are you going to say?

May 28, 2020Five of the biosimilars launched in the United States are in one drug class, called granulocyte-colony stimulating factor, or G-CSF. This drug class treats neutropenia, a condition that’s often a side effect from cancer. About 11,000 patients every year take a G-CSF drug, generally for about six months. But because it’s for patients with cancer, that patient pool continuously turns over. There are new patients with neutropenia who need G-CSF, every month, every year.¹

Those G-CSF biosimilars are priced 10 to 30 percent lower than the reference biologics. The FDA review affirms there’s no clinically significant difference between a biosimilar and its reference biologic.² One would then expect that health plans and payers would convert quickly to the biosimilars, right? To save money while delivering the same health outcomes?

Those expectations would be wrong. The availability of biosimilars, on its own, does not move the market.

A case study in preferring biosimilars shows a big difference in market adoption rates

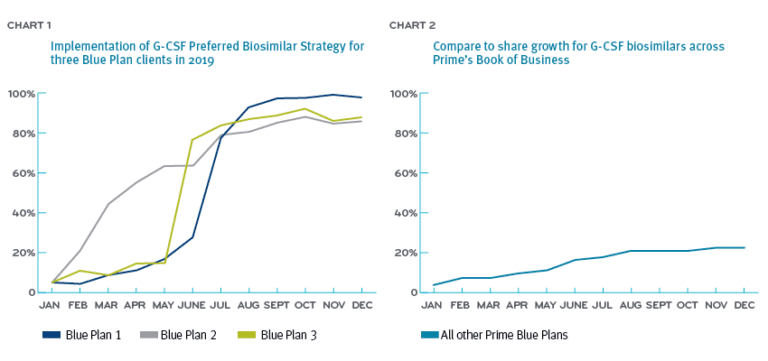

Following a September 2018 recommendation from Prime’s Medical Business Committee (formerly known as the Specialty Drug Strategy Committee), three Blue Plans changed their medical policies to prefer the biosimilars over the reference drug in the G-CSF class.

The three Blue Plans who took an active management approach (preferring biosimilars) starting in the first half of 2019, saw high conversion rates of 87 percent, 88 percent and 98 percent. Collectively, this delivered a cost savings of $4 million (Chart 1). By year-end 2019, the formulary-neutral Blue Plans saw biosimilar conversions at about 24 percent (Chart 2).

Having several biosimilars in one drug class makes it easier to implement preferred-product benefit designs. In 2019, our Blue Plans saved $4 million by using G-CSF biosimilars.

Having several biosimilars in one drug class makes it easier to implement preferred-product benefit designs. In 2019, our Blue Plans saved $4 million by using G-CSF biosimilars.

In the 90s, many consumers resisted switching to generic drugs

The FDA, health plans, employers and PBMs — everyone in the health care system — pitched in with education campaigns. Generic drugs deliver the same quality as brand-name drugs.

In some ways, we face the same consumer resistance with biosimilars today. Except now, instead of switching to generics for treating their high cholesterol or high blood pressure, we’re asking consumers to switch to biosimilars for treating cancer. It’s a bigger decision.

We work closely with our Blue Plan clients to support benefit design decisions that improve care and control costs. Prime has a customer experience team experienced with journey mapping. This gives us insights into when patients are looking for treatment information and are open to receiving it.³

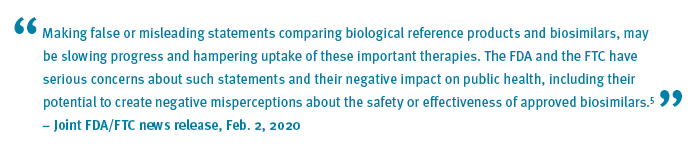

Missing facts and misinformation about biosimilars have made many health plans and employers hesitant. And that’s costing them money.4 It’s important to get the facts out there.

We’re not only educating about biosimilars, but we’re re-educating to counter the misinformation. This statement is from the FDA and FTC’s announcement to support a more competitive market for biological products.

The FDA has issued guidance6 to help clarify questions around submissions for ABLA and language around labeling and marketing. It’s putting on workshops.7 And it’s pursuing bad actors. But like the news right now – we are all responsible for checking our sources and getting good information.

Audiences within the health care system each have unique information needs

Audiences within the health care system each have unique information needs

Did you know:

Providers need continuing education. In a recent study of oncology clinicians, 77 percent could not provide a satisfactory definition of a biosimilar.8 The most important factors involved in a providers’ decision to prescribe biosimilars are safety, efficacy and cost.9

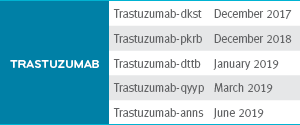

Pharmacists have concerns about managing multiple payer policies and keeping accurate health records.10 Biosimilars have the same name as the biologic; the four-letter extensions differentiate one biosimilar from another.

Most patients are not familiar with biosimilars. Oncology patients are more in the know. Depending on the kind of cancer, 60 to 70 percent know a little bit more about biosimilars.8

The next step: trastuzumab biosimilars

The multi-biosimilar approach is Prime’s blueprint for savings for trastuzumab (Herceptin®). There are five biosimilars for trastuzumab that treat breast or gastric cancer. These are all approved and launched. If Prime’s Blue Plan clients prefer these biosimilars, we estimate that potential plan savings could total $31 million over two years.

Continuing education opportunities on biosimilars will improve physicians’ and pharmacists’ ability to provide appropriate information to help patients make informed care decisions that include biosimilars.8

Continuing education opportunities on biosimilars will improve physicians’ and pharmacists’ ability to provide appropriate information to help patients make informed care decisions that include biosimilars.8

The biosimilar will not be automatically substituted for the biologic. The doctor will need to prescribe the biosimilar. (Generics could be substituted for the brand-name drug by the pharmacist at the pharmacy. This made growing their market share much simpler.)

Benefit design elements can come into play, like preferred drugs, reimbursement contracts with providers and more. Prime has a toolbox of programs it puts to work on behalf of members and payers – but always with the goal of improving health outcomes and lowering cost of care.

References

1. https://www.primetherapeutics.com/en/news/prime-insights/2020-insights/insights-2020-never-give-up-on-biosimilars.html

2. What is a biosimilar? U.S. FDA. Accessed at: https://www.fda.gov/media/108905/download

3. Prime Customer Experience Group

4. Large employers could have saved money if more biosimilars had been prescribed, By ED SILVERMAN, April 2, 2020. STAT NEWS. Accessed at: https://www.statnews.com/pharmalot/2020/04/02/biosimilars-biologics-drug-prices-

5. The FDA and FTC Announce New Efforts to Further Deter Anti-Competitive Business Practices, Support Competitive Market for Biological Products to Help Americans. Feb 2, 2020. FDA.gov. Accessed at: https://www.fda.gov/news-events/press-announcements/fda-and-ftc-announce-new-efforts-further-deter-anti-competitive-business-practices-support

6. Draft guidance: https://www.fda.gov/regulatory-information/search-fda-guidance-documents/biosimilars-and-interchangeable-biosimilars-licensure-fewer-all-conditions-use-which-reference

7. Webinar: https://www.fda.gov/drugs/news-events-human-drugs/public-workshop-fdaftc-workshop-competitive-marketplace-biosimilars-03092020-03092020

8. Ismailov RM, Khasanova ZD, Gascon P. Knowledge and awareness of biosimilars among oncology patients in Colorado, USA. Futur Oncol. 2019;15(22):2577-2584. doi: 10.2217/fon-2019-0194.

9. Cook JW, McGrath MK, Dixon MD, Switchenko JM, Harvey RD, Pentz RD. Academic oncology clinicians’ understanding of biosimilars and information needed before prescribing. Ther Adv Med Oncol. 2019;11:175883591881833. doi: 10.1177/1758835918818335.

10. Haas CE. Keep your hands off my formulary. Pharmacy Times website. pharmacytimes.com/publications/health-system-edition/2019/july2019/keep-your-hands-off-my-formulary. Published July 16, 2019. Accessed December 8, 2019.

Related news

Perspectives

July 25, 2024

Quarterly Drug Pipeline: July 2024

Clinical insights and competitive intelligence on anticipated drugs in development

Perspectives

July 22, 2024

Oncology Insights: 2024 ASCO Annual Meeting key findings

Findings from this year’s American Society of Clinical Oncology (ASCO) Annual Meeting will likely lead to clinical practice changes and U.S. Food and Drug Administration (FDA) drug approvals or expansions

Perspectives

July 16, 2024

LISTEN NOW: Beyond the business – Stories of corporate kindness | Pharmacy Friends Podcast

In this episode, we talk about how our employees' help goes beyond our work in health care, aiding in philanthropic efforts

Audiences within the health care system each have unique information needs

Audiences within the health care system each have unique information needs