Perspectives

Biosimilar strategy for drugs treating neutropenia using MedDrive™

With a plan to stimulate millions in savings, plan sponsors will prefer two biosimilars

January 29, 2022Amgen’s Neupogen® (filgrastim) is a G-CSF that was approved by the U.S. Food and Drug Administration (FDA) in 1991 to treat neutropenia. Filgrastim acts as a growth factor to help white blood cells recover after treatment.

Definition: Granulocyte-colony stimulating factor, or G-CSF is a protein that makes the bone marrow produce more white blood cells. This helps reduce the risk of infection after some types of cancer treatment.1

There are different types of G-CSF, including filgrastim, and long-acting (pegylated) filgrastim, called pegfilgrastim, originator product is Amgen’s Neulasta® (pegfilgrastim). Pegfilgrastim stays in the body longer. This means the patient needs treatment less often than with filgrastim.1

In a climate of high drug prices, Neulasta has attracted attention from the Institute for Clinical and Economic Review (ICER) for unwarranted price increases:

“After careful review of the evidence submitted by the manufacturer, we conclude that Neulasta (pegfilgrastim) had a price increase unsupported by new clinical evidence.”2

Comparing filgrastim and pegfilgrastim

U.S. guidelines support the routine use of G-CSF as primary prophylaxis (e.g., administered after the first cycle of chemotherapy) in patients receiving chemotherapy regimens where the risk of neutropenia is greater than 10%.3 Estimates suggest this number is more than 60,000 annually.

Duration of a course of G-CSF depends on the patient’s chemotherapy regimen. Many patients are on for short periods of time, often for only six months. That means the pool of patients taking G-CSF continuously turns over. There are new patients with neutropenia who need G-CSF, every month, every year.2

Filgrastim sees 35 to 45% new patients starting every month; this is called a new start rate. Pegfilgrastim growth is almost as high, at 25 to 30% new patients starting on the drug regimen every month.

Even with that many new patients, drug spend on filgrastim has been going down at a rate of -7.24% annually since 2018. This savings in drug spend is coming from the lower cost of biosimilars. Drug spend for pegfilgrastim has held steady with a drug spend growth rate of <1% since 2018.

Filgrastim is given subcutaneously or by infusion through intravenous (IV) infusion, depending on the condition. Treatment is usually patient-specific and given until the white blood cell counts return to a more normal level. Pegfilgrastim is given as a subcutaneous injection, just once following a chemo treatment.

These G-CSF biosimilars are priced 10 to 30% lower than the reference biologics. Currently, the FDA has not authorized any G-CSF biosimilars to be designated interchangeable status; however, the FDA review affirms there’s no clinically significant difference between a biosimilar and its reference biologic.4 One would expect that health plans and payers would convert quickly to the biosimilars, right? To save money while delivering the same health outcomes?

Those expectations would be wrong. The availability of biosimilars, on its own, does not move the market. The market needs nudging to move to biosimilars.

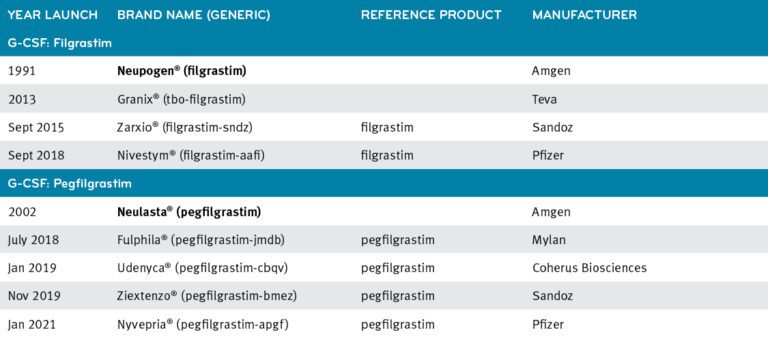

Current available G-CSF products

A case study in preferring biosimilars shows a big difference in market adoption rates

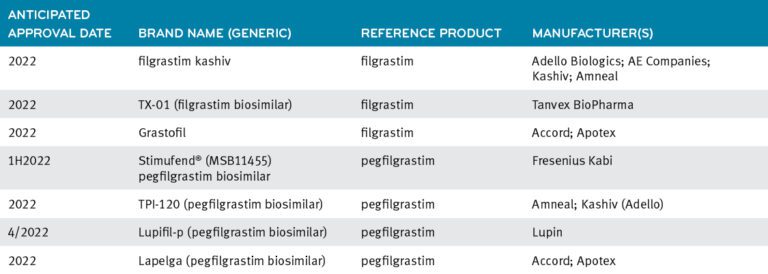

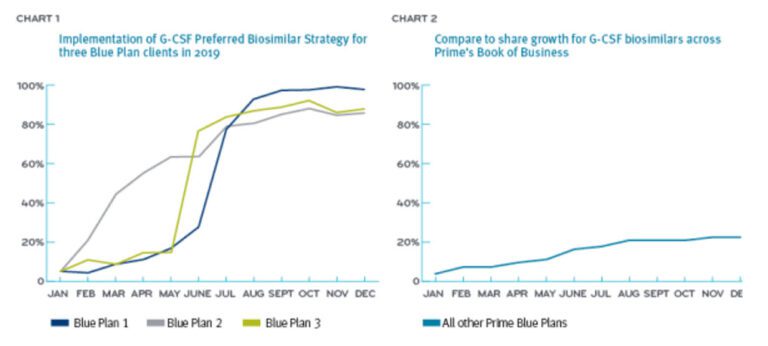

Three Prime Blue Plan clients changed their medical policies to prefer the biosimilars over the reference drug in the G-CSF class.

The three Blue Plans who took an active management approach (preferring biosimilars) starting in the first half of 2019, saw high conversion rates of 87%, 88% and 98%. Collectively, this delivered a cost savings of $4 million (Chart 1). By year-end 2019, the formulary-neutral Blue Plans saw biosimilar conversions at about 24% (Chart 2).5

MedDrive strategy for filgrastim and pegfilgrastim: prefer two biosimilars

MedDrive strategy for filgrastim and pegfilgrastim: prefer two biosimilars

The launch of MedDrive signaled that Prime and its Blue Plan clients were going to get more aggressive about biosimilar savings.

Prime’s recommended MedDrive strategy for filgrastrim and pegfilgrastim is for a combination of two preferred biosimilars over the reference drugs and other biosimilars. Having several biosimilars in one drug class makes it easier to implement preferred-product benefit designs.

Prime’s Blue Plan clients are now in the process of transitioning to preferring two biosimilars over each of the reference drugs Neupogen and Neulasta and other biosimilars.

Now that Prime has made its MedDrive biosimilar recommendations to its clients, we anticipate biosimilar market share to increase and savings to build over the next year. With more G-CSF products in the pipeline, we are optimistic about further price savings in the future.

If all Prime’s Blue Plan clients prefer biosimilars in the G-CSF space, we project savings of $50 million a year.

More G-CSF products in the pipeline6

MedDrive medical solutions is a complete toolkit

MedDrive leverages the collective strength of Prime’s client membership to help control medical costs. Client savings are obtained through:

- Improved rebates from manufacturers,

- Lower net costs with shift of use from expensive medical drugs to lower cost alternatives, such as biosimilars

- Lower cost alternatives within the same therapeutic class

Prime’s Blue Plan clients are executing preferred drug programs designed to save them hundreds of millions of dollars. We’ll continue to showcase these drugs and this analysis. For more information, contact your local Prime representative.

References

- https://www.cancerresearchuk.org/about-cancer/cancer-in-general/treatment/cancer-drugs/drugs/g-csf

- Unsupported Price Increase Report, 2019. Institute for Clinical and Economic Review. Accessed at: http://icerorg.wpengine.com/wp-content/uploads/2020/10/ICER_UPI_Final_Report_and_Assessment_110619.pdf

- GCSF Treatment guidelines – need reference

- What is a biosimilar? U.S. FDA. Accessed at: https://www.fda.gov/media/108905/download

- Prime book of business data.

- Drug Pipeline Quarterly Update: December 2021 (primetherapeutics.com)

Related news

Perspectives

July 25, 2024

Quarterly Drug Pipeline: July 2024

Clinical insights and competitive intelligence on anticipated drugs in development

Perspectives

July 22, 2024

Oncology Insights: 2024 ASCO Annual Meeting key findings

Findings from this year’s American Society of Clinical Oncology (ASCO) Annual Meeting will likely lead to clinical practice changes and U.S. Food and Drug Administration (FDA) drug approvals or expansions

Perspectives

July 16, 2024

LISTEN NOW: Beyond the business – Stories of corporate kindness | Pharmacy Friends Podcast

In this episode, we talk about how our employees' help goes beyond our work in health care, aiding in philanthropic efforts

MedDrive strategy for filgrastim and pegfilgrastim: prefer two biosimilars

MedDrive strategy for filgrastim and pegfilgrastim: prefer two biosimilars