Perspectives

Hemophilia A costs increase with switch to extended half-life factor

Study questions value of high cost switch to extended half-life factor products

July 31, 2018What was the study about?

Hemophilia only affects about 20,000 Americans, but costs can run $250,000 to $500,000 per year or more. This far exceeds pharmacy spending for many other chronic disease conditions. This study analyzed integrated pharmacy and medical claims to learn:

- Number of members with hemophilia A and hemophilia B treated with factor products by time intervals

- Percentage of members using EHL units over time

- Change in factor units used for members that switched from SHL to EHL factor products

What did we learn?

Members switching to a hemophilia B EHL product were associated with a decrease in average number of units dispensed. By contrast, members switching to a hemophilia A EHL product were associated with an increase in average number of units dispensed. Instead of using less, they used more.

Because the EHL factor products were more expensive than the SHL products, overall costs increased for both hemophilia A and B members, but even more dramatically for hemophilia A.

Methods

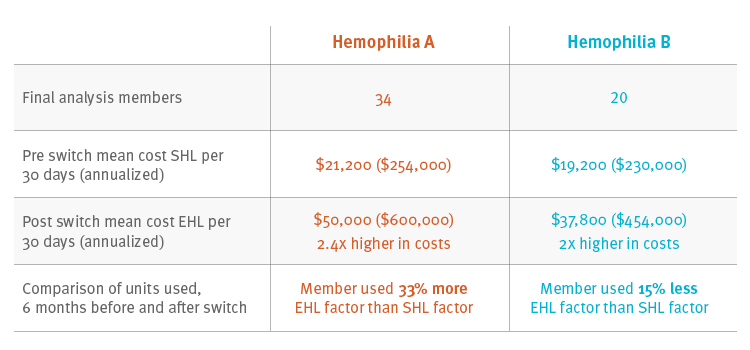

We started from a commercially insured population averaging 15 million members, looking for continuously enrolled members from Jan. 2013 to July 2017. We looked for pharmacy and medical claims for members with a hemophilia factor claim. Those members who had switched from SHL to EHL were followed at 6 month intervals; we assessed therapy and costs 6 months before and after the switch. There were 34 hemophilia A and 20 hemophilia B members who switched from a SHL to an EHL product and met study criteria.

Results

For the 34 members with hemophilia A, mean annual cost for SHL was $254,000 compared with $600,000 (2.4 times higher) for EHL. For the 20 members with hemophilia B, mean annual cost for SHL was $230,000 compared with $454,000 (2 times higher) for EHL. Members with hemophilia B used less of the EHL factor product – for them, the product was performing as expected. But members with hemophilia A used more factor product – 33 percent more.

Cost and utilization for members that switched from a SHL to an EHL product

Conclusions

The EHL factor products are double the expense of SHL factor products. This study suggests that EHL can reduce the number of factor units used by hemophilia B patients. This study suggests little to no clinical value for most hemophilia A patients.

Utilization management (UM) can help to avoid waste and provide clinical documentation to validate EHL therapy is being started in the optimal patients. With UM, savings can be achieved while maintaining clinical safety and efficacy.

What does this mean for you?

Prime has a utilization management strategy to help manage factor products. Prime provides plan sponsors with formularies that are clinically complete and cost effective. This helps manage high specialty drug costs associated with chronic and rare conditions such as hemophilia.

If this drug category is not managed, it could have a major impact to pharmacy spend. If the 80 percent of Prime’s members with hemophilia A who now use SHL products switched to EHL, drug spend could increase by more than $130 million per year.

Use of EHL products with hemophilia A has led to substantial increases in the cost of hemophilia treatment in this commercially insured population. Further migration to EHL by this population needs to be justified clinically.

Related news

Perspectives

April 24, 2024

Prime/MRx resident wins AMCP Foundation Best Poster Award

Ai Quynh Nguyen, PharmD, was recently recognized for her research on opioid-prescribing patterns and outcomes

Perspectives

April 23, 2024

Expert Clinical Network Insights: April 2024

A look into our Expert Clinical Network (ECN) – part of Prime/MRx’s value-based approach to medical and pharmacy benefit management that offers access to more than 175 national and world-renowned key opinion leaders in multiple disease categories who provide expertise on challenging prior authorization case reviews, peer-to-peer discussions, drug policy development and formulary guidance

Perspectives

April 23, 2024

April Fraud Focus – How to prioritize drug safety at home

While ensuring drug safety is often considered the responsibility of pharmaceutical industry players,…