Perspectives

Dispel the mysteries of the autoimmune drug category

The autoimmune drug category is so large it can seem inscrutable.

October 14, 2021We combined integrated claims with diagnosis codes and UM data to uncover indication-specific drug costs.

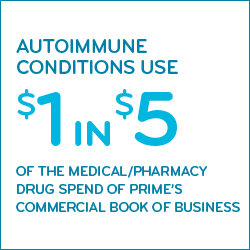

Treating autoimmune conditions consumes more than $1 in $5 of combined medical/pharmacy drug spend for Prime’s commercially insured book of business. It accounts for $6.7 billion annually across Prime’s book of business. And those costs have been doubling every three or four years.

This aggressive growth needs aggressive management. That can only be done with the right information at the right time. Prime’s sophisticated analytics shine a light into the hard-to-reach corners of pharmacy data.

What factors make the autoimmune category so big?

What factors make the autoimmune category so big?

The costs have been doubling every three or four years, caused by:

- High inflation by many (not all) of the drugs in this category

- New drugs – many providing welcome medical advancements in treatment

- Increased utilization – higher patient counts – for many conditions

- Patient dose escalation among some, leading to higher costs to treat the condition

The average annual cost for one specialty medication used on a chronic basis is more than $78,000.1 (That cost would have been under $30,000—almost $50,000 lower—if the retail price changes for these drugs had been limited to general inflation between 2006 and 2017.1)

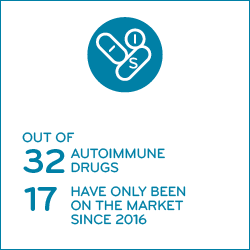

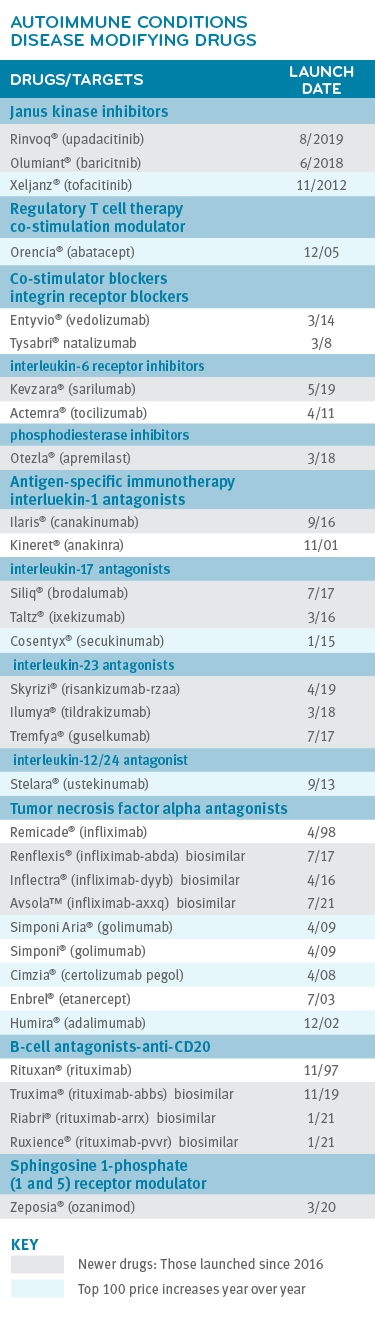

In 2019, we studied a group of 29 drugs that treat autoimmune (AI) conditions.

Nearly half of the 29 drugs in the Prime study are new — 14 of them have been approved and launched in just the last five years, since 2016. These drugs reflect new advancements in treatment and improved quality of life. For several AI conditions, drug costs make up most of a member’s total cost of care.2 Some of the older drugs are fighting back to hold market position with price increases. Six of them made a list of the year’s top 100 year-over-year price increases.3

There is no cure for AI disorders, but drugs can help improve symptoms or slow disease progression. Because drug therapy is the primary mode of treatment, drug costs typically make up the majority of the cost of care.2 Increased adherence to drug therapy improves quality of life but does not return savings in cost of care. In fact, it will often increase costs.

What makes the autoimmune drug spend so complex?

More than 80 autoimmune conditions affect up to eight percent of the U.S. population. Most of the drugs that treat autoimmune conditions have been approved to treat several different conditions.

Seven conditions accounted for the bulk (more than 95%) of the autoimmune drugs taken by Prime members:4

Seven conditions accounted for the bulk (more than 95%) of the autoimmune drugs taken by Prime members:4

- rheumatoid arthritis

- psoriasis

- Crohn’s disease

- psoriatic arthritis

- ulcerative colitis

- ankylosing spondylitis and

- hidradenitis suppurativa

Many of these drugs are covered under the medical benefit. Therefore, to comprehensively understand AI drug utilization trends and drug therapy optimization opportunities integrated medical and pharmacy claims data analytics is essential.

At an individual level, adding to the complexity, many AI conditions are difficult to diagnose, and difficult to manage. They may have a genetic component and/or an environmental trigger. Many AI disorders have several subtypes with distinct features of their own. Often symptoms vary by patient. Patients can go years before getting a correct diagnosis.3 Even once diagnosed, disease progression is often unpredictable and nonlinear and treatment plans may need frequent adjustment.

Many different types of drugs treat autoimmune diseases. Traditional drug treatment options may include immunosuppressant drugs to address the heightened overall immune response, such as:

Many different types of drugs treat autoimmune diseases. Traditional drug treatment options may include immunosuppressant drugs to address the heightened overall immune response, such as:

-

-

-

-

-

-

- Non-steroidal anti-inflammatory drugs (NSAIDs) to reduce inflammation

- Glucocorticoids to reduce inflammation

- Disease-modifying anti-rheumatic drugs (DMARDs) to decrease the damaging tissue and organ effects of the inflammatory autoimmune response

-

-

-

-

-

Advancements in treatment work towards suppressing the specific autoimmune inflammatory pathway while leaving the rest of the immune system active so it can fight back against other infectious diseases and cancers. These kinds of immunotherapy treatments are less toxic to the patient. These include:

-

-

- Monoclonal antibodies designed for targeted immunosuppression

- Antigen-specific immunotherapy which allows immune cells to specifically target the abnormal cells that cause autoimmune disease

- Co-stimulatory blockade that works to block the pathway that leads to the autoimmune response

- Regulatory T-cell therapy that utilizes a special type of T-cell to suppress the autoimmune response

-

Prime’s actionable analytics cuts through the complexity

To learn more about this group of disorders and drugs, Prime constructed a research model that sorted drug use by indication. Prime cross-referenced integrated medical and pharmacy claims data with utilization management (UM) information and applied other proprietary coding logic. With this detailed analysis, Prime was able to separate use of the 29 drugs into disease categories. This allowed Prime to track drug cost by condition.

The case for AI indication-specific contracting

Value-based contracting can provide an important cost control for many high-priced specialty drugs. But with AI conditions, it gets tricky. It’s not unusual for different people with the same condition to receive different doses of the same drug. A value-based contract can accommodate those variations. But across autoimmune conditions, dosing differences can vary widely. In these cases, indication-specific contracting becomes more important.

For example, Stelara® is approved to treat four different AI conditions. Three months’ dosing of Stelara for plaque psoriasis costs an average of $17,271. Three months’ dosing of Stelara for Crohn’s disease costs $39,579. The cost of Stelara was 2.3 times higher to treat Crohn’s disease than it was to treat plaque psoriasis.4

Variables like patient weight, loading doses, frequency between doses and site of care all contribute to these cost differences. But they also make a strong case for indication specific value-based contracts.

Client-specific AI profiles customize strategies to the client need

Prime provides client-level reporting of indication-specific AI drug utilization. Other PBMs cannot provide that level of detailed reporting or custom strategy. This reporting shows the strategies that will most quickly yield the most AI savings, by client.

This customization is crucial because each Blue Plan market is different. For example, incidence of Crohn’s disease is higher in some areas of the country. There are regional patterns of provider practices in uses of medication that a Blue Plan may want to keep in mind.

Maximizing biosimilar use

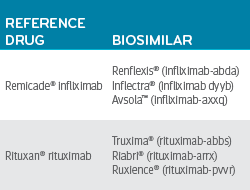

Looking at indication-specific drug costs also shows where the best opportunities are to maximize conversion to biosimilars.

While many AI drugs are new, a few, like Remicade and Rituxan, have been around long enough to produce biosimilar price competition.

For Crohn’s disease, in the second quarter of 2020, the reference drug Remicade (infliximab) had an average quarter per member cost of $10,000. Most members taking infliximab were on the reference drug. Less than 5% of members using infliximab were using a less expensive biosimilar infliximab product.

For Crohn’s disease, in the second quarter of 2020, the reference drug Remicade (infliximab) had an average quarter per member cost of $10,000. Most members taking infliximab were on the reference drug. Less than 5% of members using infliximab were using a less expensive biosimilar infliximab product.

If just half of the members taking the reference drug infliximab moved to a lower-priced biosimilar infliximab, Prime could save tens of millions of dollars across its book of business.

We can do better. We support the use of use of evidence-based, lower-cost biosimilars, instead of higher-cost reference drugs. The sooner the better. It would be great if we could post significant improvements here.

Biosimilars are just one strategy of many to reduce drug costs

We can filter a client’s entire AI portfolio through a range of specialty solutions to maximize savings. Biosimilars are a big strategy, but this obviously only works in drug classes where there are biosimilars available. Other strategies include benefit design and cost share, site of care, medical policy review, reimbursement strategies, provider contracting, and more.

When it comes right down to it, the strategies are crafted one client at a time, one condition at a time, one drug at a time. And you can only do that with indication-specific drug costs.

References

- Rx Price Watch Report: Specialty Prescription Drug Prices Continue to Climb. By Stephen W. Schondelmeyer and Leigh Purvis. June 2019. AARP Public Policy Institute. Accessed at: https://www.aarp.org/content/dam/aarp/ppi/2019/06/specialty-prescription-drug-prices-continue-to-climb.doi.10.26419-2Fppi.00073.002.pdf

- Unsupported Price Increase Report: 2020 Assessment. Institute for Clinical and Economic Review, January 12, 2021. Accessed at: https://icer.org/assessment/unsupported-price-increase-2021/.

- https://www.primetherapeutics.com/en/news/pressreleases/2021/release-2021-data-inform-drug-therapy-management.html

- Challenges, Progress, and Prospects of Developing Therapies to Treat Autoimmune Diseases. By Lars Fugger, Lise Torp Jensen, and Jamie Ross. Volume 181, Issue 1, 2 April 2020, Pages 63-80. © 2021 Elsevier B.V. ScienceDirect ® is a registered trademark of Elsevier B.V. Accessed at: https://www.sciencedirect.com/science/article/pii/S0092867420302695

Related news

Perspectives

April 25, 2024

Drug Approvals Monthly Update: April 2024

This monthly update of United States (U.S.) Food and Drug Administration (FDA) approvals…

Perspectives

April 24, 2024

Prime/MRx resident wins AMCP Foundation Best Poster Award

Ai Quynh Nguyen, PharmD, was recently recognized for her research on opioid-prescribing patterns and outcomes

Perspectives

April 23, 2024

Expert Clinical Network Insights: April 2024

A look into our Expert Clinical Network (ECN) – part of Prime/MRx’s value-based approach to medical and pharmacy benefit management that offers access to more than 175 national and world-renowned key opinion leaders in multiple disease categories who provide expertise on challenging prior authorization case reviews, peer-to-peer discussions, drug policy development and formulary guidance