Perspectives

Cost management for sky-high, high-cost gene therapy

No matter what the price of the latest gene therapy, we can still help

August 17, 2021We can still put cost management levers in place to help us get the best health outcomes for the lowest price (even when the price is more than $1 million).

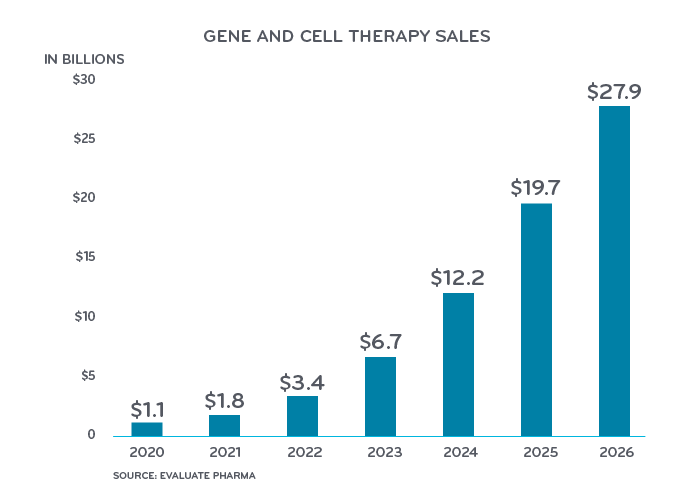

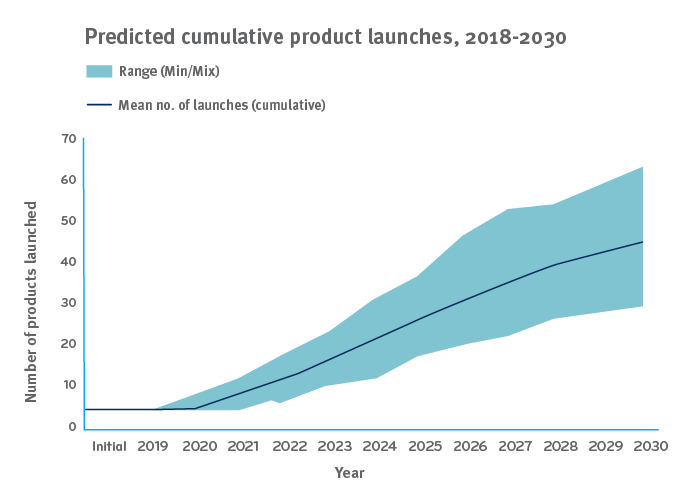

Gene and cell therapies are highly targeted, highly effective therapies used to treat, cure, or even prevent specific diseases. Some are used for rare and orphan conditions that affect just a few thousand people in the whole country. There are just a handful available today, but more are coming. By 2025, the FDA may be approving 10 to 20 cell and gene therapy products annually.¹ It looks like 60 or more will be on the market by 2030.²

Think of these high-cost therapies like a monster truck. It looks great from a distance, but it’s pretty scary when it’s right on top of you.

New treatments create new challenges for payers

Durability: Many gene therapies are designed to be a one-time treatment. But often expedited clinical trials only last for two or three years. And the test group may only include 20 or 30 patients.

What happens if the effect of the gene therapy wears off? What’s the right treatment then? Does the physician prescribe the one-time-only treatment again? Or return to other treatments?

What happens when a gene therapy that is supposed to be a cure, isn’t?

For example, Prime’s study of CAR-T patients found 40% of patients did not have a durable response to CAR-T administration.³

Health plans, through their Pharmacy and Therapeutics Committees, will be put in the tough spot of deciding appropriate coverage and self-insured employer groups may be considering whether or not to cover these new therapies.

Budget pressures: A small group might go years without having a member that needs one of these rare and high-cost treatments. But health insurance isn’t like a trip to Las Vegas. A small group doesn’t get to gamble that a rare condition will continue to pass them by. It can be hard for a small group to budget for the significant impact it could have on their expenses. (In fact, nearly one third of small employer groups surveyed indicated they were likely to exclude coverage for gene therapies.4 That’s one way to approach it, but as clinical data builds, that won’t be a realistic option.)

Many of these new gene therapies are for conditions that do not have treatment options today. Patients may be unknown until they present a need and seek a gene therapy drug. If a group does not have appropriate coverage, stop loss or reinsurance in place they are essentially betting that they will not incur one of these high cost claims. Today, odds are in their favor on a yearly basis, but as more of these gene therapies come to market these odds will get worse.

Members on the move: Some of the financing options that are examined are value-based. They may require clinical follow-up on the member to fulfill contract requirements. When members change jobs, they often change health insurance. This makes getting lab data more difficult. If those members’ data are part of any value-based contract dependent on clinical follow up, the health plan may lose out on capturing back any value from that contract. That could ultimately make the original gene therapy more expensive.

These are all factors to consider as a health plan explores financing options for gene and cell therapy.

Approaches to cost management for gene therapy

Costs for gene and cell therapy products on the market today range from $373,000 to $2.1 million. Gene and cell therapy drug spend was estimated at $1 billion in 2020 and total U.S. costs are projected to rise to $27 billion a year by 2026.5

In the short-term, the current payment system will struggle along. We will continue to see familiar purchasing systems like buy and bill, fee for service and center of excellence networks. Manufacturers and payers will come under increasing pressure to enter into value-based arrangements. Manufacturers will need to guarantee that their products do what they claim.

In the mid/long term, other payment options will begin to emerge. It will take time for the market to develop more sophisticated, alternative finance options. Current benefit, contracts, and payment systems will need to evolve. There will be an increased focus on value. Systems and contracts that track outcomes will have a jump on getting to this next stage.

Health plans are starting to explore several options for funding expensive gene therapies.

Annuities: Annuities might be available to a patient or a health plan. One type of annuity can spread payments out over a defined period of time, two or more years. An individual annuity converts a one-time upfront cost to payments over time.

Outcomes/milestone-based contract: This is an outcome-based contract with the manufacturer that connects an annuity payment for a drug, contingent to a positive health outcome. It can also be written as a rebate based on performance failure (i.e., efficacy, durability, safety, etc.).

Health Affairs conducted an online survey of pharmacy directors from national and regional managed care organizations. In a new financing model, nearly all payers said they would expect payment to be dependent on meeting performance-based requirements.4

Risk pooling: Plans or employers pay into a pool, based on size, so individual plan sponsors won’t have to bear the full cost. Contributions are based on standard reinsurance or state-level bonding.

Stop-loss funding programs that are gene-specific: Stop-loss is a common financial risk mitigation insurance tool used today to protect groups from high costs. Now we are starting to see gene-therapy specific ones come to market, or buy-ups within current offerings that help cover the cost of these products.

Reinsurance gene-specific programs: In 2020, Prime and BCS Insurance Company introduced PreserveRxSM, its gene therapy reinsurance solution. PreserveRx is an excess reinsurance product with configurable attachment points for health plans. It covers gene therapies at 100% of WAC. Pricing is set at a per member per month premium.

PreserveRx seeks to protect both health plans and employers from sudden, one-time costs due to covering ultra-expensive gene therapies, while preserving access to these potentially life-changing or curative gene therapies for members. This clinical and financial solution is specifically designed to reinsure high-cost gene therapies for payers that cover these gene therapies and help preserve member access and coverage for these life-altering therapies.

Portable patient registries are financing arrangements that smooth payments over time, where the “payment follows the patient” from payer to payer. For example, Joe Smith has his CAR-T treatment while insured by Blue Plan X, who begins four years of payments to the manufacturer. Two years later, Joe gets a new job and is insured by Blue Plan Y. The CAR-T contract follows Joe to Blue Plan Y and Blue Plan Y begins the final two years of payments to the manufacturer.

(Almost three-fourths of the respondents in this Health Affairs survey did not like the idea of portable patient registries.4 My guess is that respondents were thinking about the complications of PHI. I bet if it was made easier by a trusted independent party, the concept of portable patient registries might be more favorable.)

Deriving the most from small samples

Many of the studies Prime conducts have cohorts in the thousands or even tens of thousands. Prime’s study on CAR-T has 74 patients. Prime has only seen a handful of patients that have taken Luxturna and Zolgensma in our plan populations, but some observations are still worth noting in terms of potential cost-saving levers.

Savings might be possible in the mark-up on CAR-T

The wholesale acquisition cost (WAC) of CAR-T-cell therapies to treat B-cell lymphomas is $373,000. In Prime’s study of 74 patients receiving CAR-T therapy,(link) we saw drug costs vary widely. Costs came through at WAC plus 50% to 100% and even more.

Across the 74 patients, the mean CAR-T drug & care episode costs were $711,000. But there was a wide range of costs for the 86-day CAR-T episodes observed including 12% of cases that cost more than $1M. This wide variation in CAR-T administration cost might provide a savings opportunity.

In February 2021, the FDA approved a third CAR-T treatment for relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy: Bristol Myers Squibb’s Breyanzi (lisocabtagene maraleucel).

Having three CAR-T options for the same indication: Kymriah, Yescarta and Breyanzi, may open up options for value-based purchasing agreements as clinical experience grows.

Luxturna has not shown much price variation in implementation

Luxturna is an injection given in the eye to help cure inherited retinal disease. The WAC is $850,000 for both eyes. All of the claims for Luxturna came in at or near the WAC with little or no mark-up. Prime has seen about half of claims for this drug come through a specialty pharmacy, and about half of the claims come through physicians’ offices on a buy and bill basis. Both of those channels – the specialty pharmacy and the physician’s office – are channels that typically mark-up drugs. It’s part of the revenue they count on. The purchase order/letter of agreement must have specified no mark-up.

Luxturna is administered at just 11 centers of excellence across the country.6 Because Luxturna is administered on an outpatient basis, nondrug costs varied little, and ranged from $20,000 to $40,000.

Zolgensma’s manufacturer offers pay-over-time option

Zolgensma treats spinal muscular atrophy (SMA), a rare, genetic disease that affects approximately one in 11,000 babies.7 The wholesale acquisition cost (WAC) for the one-time intravenous infusion of Zolgensma is $2.125 million per treated patient. This one-time only, intravenous infusion, has the ability to fjx the underlying gene mutation that causes SMA. It is approved for use on children with SMA Type 1 under two years of age.

Prime has seen drug claims for Zolgensma paid near WAC, with minimal variation. Nondrug costs charged for infusion have run in the low thousands, without much variation.

Most of the drug claims have come through a specialty pharmacy. Only a few drug claims have come through physicians’ offices as buy and bill.

Place of administration has consistently been outpatient, at select centers of excellence. There are about 100 authorized centers of excellence.7

Novartis offers insurers a pay-over-time option of $425,000 a year for five years.

Making informed choices and finding an acceptable balance

Prime’s total drug management works to balance breakthrough treatments like gene therapy with responsible and careful cost management. We analyze fully integrated medical and pharmacy data to understand the entire scope of a patient’s health. Prime will continue to provide actionable data to help our clients:

- Look at issues of both affordability and accessibility

- Prepare for the coming wave of high costs and member needs

- Evaluate funding options through both a financial and clinical lens

There will be no one-size-fits-all solution. At Prime, we strive for financial protection, backed by clinical intelligence, to reduce high-cost gene therapy risk.

References

- Statement From Scott Gottlieb, M.D, Jan. 15, 2019. U.S. FDA. Accessed at: https://www.fda.gov/news-events/press-announcements/statement-fda-commissioner-scott-gottlieb-md-and-peter-marks-md-phd-director-center-biologics

- Estimating the Clinical Pipeline of Cell and Gene Therapies and Their Potential Economic Impact on the US Healthcare System Quinn, Casey et al. Value in Health, Volume 22, Issue 6, 621 – 626 Accessed at: https://www.valueinhealthjournal.com/article/S1098-3015(19)30188-3/fulltext

- “Prime Therapeutics’ study shows total cost of care for CAR-T plus post-treatment events can exceed $1 million.” April 21, 2021. Prime Therapeutics Newsroom. Accessed at: https://www.primetherapeutics.com/en/news/pressreleases/2021/release-2021-cost-of-care-car-t-exceed-million.html

- Are Payers Ready To Address The Financial Challenges Associated With Gene Therapy? By Michael Ciarametaro, Genia Long, et al. June 18, 2018. Health Affairs. Accessed at: https://www.healthaffairs.org/do/10.1377/hblog20180626.330036/full/

- EvaluatePhama Data, as quoted in “Leveraging the untapped potential of cell and gene therapies,” May 6, 2021. Matthias Buente, Morris Hosseini and Thilo Kalternbach. © Roland Berger. Accessed at: https://www.rolandberger.com/en/Insights/Publications/Cell-and-gene-therapies-Pharma’s-next-big-wave.html

- Luxturna: https://mysparkgeneration.com/hcp-support.html#TreatmentCenters

- SMA Foundation: https://curesma.wpengine.com/find-a-location

Related news

Perspectives

April 19, 2024

AMCP 2024: Behind the Research with Prerak Parikh

Parikh, director of medical pharmacy strategy at Prime/MRx, shares the latest on interchangeable biosimilars

Perspectives

April 19, 2024

LISTEN NOW: Live at AMCP Annual 2024 – Digging into managed care pharmacy insights | Pharmacy Friends podcast

In this episode, Prime/MRx clinicians — along with special guests — discuss the hottest topics covered at the Academy of Managed Care Pharmacy (AMCP)'s 2024 Annual Meeting in New Orleans

Perspectives

April 17, 2024

AMCP 2024: Behind the research with YuQian Liu

Ahead of her session with Andy Killpack, Liu — senior director of specialty clinical solutions at Prime/MRx — shares current care management strategies for cell and gene therapy and the future of this exciting frontier