Perspectives

Biosimilars: barriers to launch

Approved biosimilars waiting on the shelf

May 22, 2020Since 2015, the FDA has approved 24 biosimilars for nine reference biologics. But only 12 of those had been launched, as of the end of 2019.

It’s a rocky road the manufacturer must take to get to market. When a biosimilar gets approved, why isn’t it launched right away? Why would a manufacturer hold it back?

The biosimilar manufacturer may invest $100 to $200 million, and eight to 10 years to prepare an abbreviated biologics license application (ABLA). (By contrast, a new generic might cost $1 to $5 million, and take just three to five years to win approval.)1

It’s not unusual to have ten or more manufacturers producing the same generic. But huge time and financial investments are required to produce a biosimilar. That means that only a few biosimilars will be produced for any drug class.

The biosimilar manufacturer often faces legal and patent issues, among others

Patent lawsuits. An original biologic often holds hundreds of patents. Its manufacturer often files lawsuits on behalf of many of those patents to delay the market launch of a biosimilar. Keeping a patent in force longer means more profit while manufacturer retains its exclusive market share. (And bonus – battling these lawsuits stalls the launch of an approved biosimilar.)

Rebates. This is when a manufacturer offers a pharmacy benefit manager (PBM) a higher rebate for a drug or a bundle of drugs. In exchange, the PBM doesn’t put the competing biosimilar on formulary.3 The original biologic keeps its favored placement on formularies. This makes the lower-priced biosimilar actually cost more. How? If one doctor prescribes the biosimilar to one patient, rebates dollars are withheld from thousands of biologic claims.

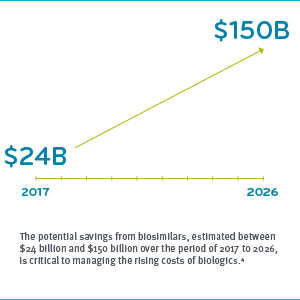

Didja hear about that biosimilar? Misinformation campaigns. Some manufacturers may mislead about the differences between the original biologic and its biosimilars. This discourages doctors and patients from moving to biosimilars.4

Pay for delay. Some biologic manufacturers pay biosimilar manufacturers to delay market launch. This stretches their period of market exclusivity. The biosimilar manufacturer will want to settle any patent disputes with the biologic manufacturer.

A look at these tactics in practice in the market

A study commissioned by the ERISA (Employee Retirement Income Security Act) Industry Committee looked at claims from 16 large corporations.3 The study audited biosimilar claims for the market penetration of two drug classes, Neupogen and Remicade.

Biosimilars market penetration by drug class3

Both biosimilars show significant discounts over their biologic reference drugs. The Neupogen biosimilar was dispensed 68 percent of the time.

Remicade was dispensed 0.5 percent of the time. Almost not at all.

Mariana Socal, an ERISA study coauthor, and an assistant scientist in the Department of Health Policy and Management at the Johns Hopkins Bloomberg School of Public Health, called these results clear evidence of a rebate trap, and an indication that brand-name products were being offered more favorable placement on formularies.3

Brand-name biologics: still preferred for most benefit designs

A Journal of American Medical Association (JAMA) study looked at plan designs for 17 major health plans in 2020. JAMA just released a study of 17 of the largest health plans in the country. The 17 health plans represent 60 percent of Americans covered by commercial health plans. More than 500 separate coverage decisions were made across those health plans (because biosimilars treat many different conditions). Ten of those 17 health plans chose not to offer preferred coverage for biosimilars at all.5

A Journal of American Medical Association (JAMA) study looked at plan designs for 17 major health plans in 2020. JAMA just released a study of 17 of the largest health plans in the country. The 17 health plans represent 60 percent of Americans covered by commercial health plans. More than 500 separate coverage decisions were made across those health plans (because biosimilars treat many different conditions). Ten of those 17 health plans chose not to offer preferred coverage for biosimilars at all.5

Just two of these health plans made biosimilars a preferred choice half of the time or more.5 These tactics are getting push back. In February 2020, the FTC and FDA announced new efforts to prevent these anti-competitive business practices, and to better support a competitive market for biological products.2

Building a market takes time and careful planning

It wasn’t easy for generic drugs. Brand-name drug manufacturers resisted the influx of generics in every way they could. It wasn’t until 2002 that the percentage of generic prescriptions filled passed 50 percent. That was 18 years after the Hatch-Waxman Act.6

As Prime watches the drug pipeline, we monitor future developments in all drug classes and therapeutic categories. We leverage the latest outcomes-based information when making recommendations to our clients. We identify biosimilar savings opportunities — often well before they come to market.

Prime’s Medical Business Committee (formerly known as the Specialty Drug Strategy Committee) works to make recommendations to achieve better health outcomes at the lowest net cost for plans and members.

References

1. Emerging Health Care Issues: Follow-on Biologic Drug Competition. Federal Trade Commission Report, June 2009. Ftc.gov.

2. The FDA and FTC Announce New Efforts to Further Deter Anti-Competitive Business Practices, Support Competitive Market for Biological Products to Help Americans. Feb 2, 2020. FDA.gov. Accessed at: https://www.fda.gov/news-events/press-announcements/fda-and-ftc-announce-new-efforts-further-deter-anti-competitive-business-practices-support

3. Large employers could have saved money if more biosimilars had been prescribed, By ED SILVERMAN, April 2, 2020. STAT NEWS. Accessed at: https://www.statnews.com/pharmalot/2020/04/02/biosimilars-biologics-drug-prices-

4. Biosimilar Cost Savings in the United States: Initial Experience and Future Potential. Mulcahy AW, Hlavka JP, Case SR. Rand Health Q. 2018 Mar 30;7(4):3. eCollection 2018 Mar. Accessed at: https://www.ncbi.nlm.nih.gov/pubmed/30083415

5. “Biosimilars got the cold shoulder from health plans when it came to preferred coverage,” By ED SILVERMAN. STATNEWS @Pharmalot. MAY 20, 2020 Accessed at: https://www.statnews.com/pharmalot/2020/05/20/biosimilars-biologics-health-coverage-drug-prices/

6. https://cen.acs.org/articles/92/i39/30-Years-Generics.html

Related news

Perspectives

April 25, 2024

Drug Approvals Monthly Update: April 2024

This monthly update of United States (U.S.) Food and Drug Administration (FDA) approvals…

Perspectives

April 24, 2024

Prime/MRx resident wins AMCP Foundation Best Poster Award

Ai Quynh Nguyen, PharmD, was recently recognized for her research on opioid-prescribing patterns and outcomes

Perspectives

April 23, 2024

Expert Clinical Network Insights: April 2024

A look into our Expert Clinical Network (ECN) – part of Prime/MRx’s value-based approach to medical and pharmacy benefit management that offers access to more than 175 national and world-renowned key opinion leaders in multiple disease categories who provide expertise on challenging prior authorization case reviews, peer-to-peer discussions, drug policy development and formulary guidance