Pharmacy benefit management pricing simplified

Pharmacy benefit management (PBM) pricing can be challenging because different PBMs present pricing in different ways, often using complex spreadsheets that make direct comparisons difficult. That’s why understanding key concepts and knowing the right questions to ask can help you make the best decision for your business.

Simplifying 6 key pricing concepts

Price vs. cost:

These words can have different meanings: Price is the value that appears on a PBM proposal, while cost is what you end up paying.

- Consider more than just price when choosing a PBM. The price you see in a contract may not be what you end up paying. There are many pricing approaches that may obscure true costs — meaning you could end up paying a higher cost for a better-looking price.

Drug categories:

There are no universal definitions for different kinds of drugs. Each PBM can define drug categories differently, which can affect perceived discounts.

- Ask your PBM how they define generic, brand and specialty drugs. Ideally, they would use an industry standard classification such as Medi-Span.

- Verify how your PBM determines average wholesale price (AWP). The most accurate and respected source is the industry standard, Medi-Span, but some PBMs use other drug data sources.

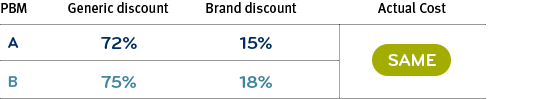

How seemingly higher and lower discounts can actually cost the same

PBM A: Defines generic and brand drugs against an independent drug list like Medi-Span.

PBM B: Defines single- and dual-source generic drugs as brand drugs. These drugs often cost more than generics but often behave like brand name drugs. Redefining lets PBM B show higher discounts in both categories.

Rebates and discounts:

The difference in how PBMs express their rebates and discounts is important. Not all claims are considered eligible for rebates, which is why PBMs may use language like “per rebatable claim.”

- Understand which claims are eligible for rebates. This could be different depending on the drug’s supply (e.g., 90 days) or delivery channel (e.g., central fill pharmacy).

- Clarify any contract language that is ambiguous or vague. For example, if the PBM contract does not list drug types like multi-source brands or vaccines as either included or excluded from rebates, ask for clarification in writing.

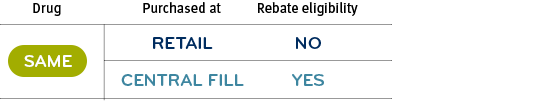

How rebate eligibility differences can change overall cost for the same drug

A 10-day supply of a drug may not be rebatable, but a 30-day supply of the same drug might be.

Or, a 90-day supply of a drug purchased at retail may not be rebatable, while the same drug purchased through a central fill pharmacy would be.

Administrative (admin) fees:

Each PBM may offer different services under their admin fees. For example, drug utilization review services are often a standard part of processing a claim, but some PBMs may charge separately for these services.

- Review which services are included as standard and which may drive additional charges. Sometimes a price quote seems too good to be true because there are charges later in the proposal for services not included as part of standard service.

Pricing types:

There are two types of PBM pricing strategies: traditional (spread) pricing and pass-through pricing. Each approach has its own benefits, but they can be challenging to directly compare.

- Dig in to determine the true costs of different pricing strategies. Spread pricing quotes can look like you’re getting deeper discounts, and pass-through pricing can look like you’re paying higher fees. The truth is often more complex, and sometimes two different quotes can result in the same cost.

Additional considerations:

There are several other ways PBMs derive revenue. Check what’s included in the price quote and ask your PBM:

- Is there a charge for rejected claims? If an employee’s prescription is rejected due to a benefit or other issue, some PBMs may still charge for the transaction.

- Is there a charge for zero balance claims? These are claims where the employee pays the full cost and the plan sponsor is billed $0.

- What is included in the PBM’s guarantee language? When reviewing the contract, look for any phrases that limit how guaranteed discounts work. For example, do guaranteed discounts apply only to a certain subset or type of claim?

- Does the PBM apply its maximum allowable cost (MAC) list at home delivery pharmacies? Using a MAC list helps prevent high-cost drugs from being dispensed when there are less expensive alternatives. Some PBMs don’t apply a MAC list at their own home delivery pharmacy, enabling them to offer seemingly deep discounts on higher-cost products.

- Is the formulary too restrictive (e.g., too many exclusions, locking out too many therapies)? Some PBMs may charge to perform a clinical review as well as approve coverage of excluded therapies. If so, the PBM may be overstating the value of the exclusions.

Uncovering the true cost of pharmacy benefit

Using per member per month, or PMPM, is one of the most accurate and transparent methods to measure your actual costs and savings.

Exploring key PBM terms

Another component of choosing your PBM is understanding all the terms PBMs use so you can feel confident about any decisions you make.